Gold, a symbol of wealth and power, has mesmerized civilizations across millennia, anchoring economies, and underpinning monetary systems. Its journey from the ancient goldsmiths to today’s electronic trade gold platforms encapsulates a rich history filled with intrigue, innovation, and the inherent human drive toward economic stability and prosperity. This exploration delves deep into gold’s pivotal role in shaping financial markets, offering a panoramic view of its undiminished allure and enduring value.

Gold: The Eternal Standard

The Dawn of Gold as Currency

The inception of gold as a cornerstone of financial systems dates back to ancient civilizations where it was prized for its rarity and beauty. The Egyptians, dating to around 3,000 BC, were among the first to mine and refine gold, using it to craft jewelry and religious artifacts. However, it was the Lydians, in the 7th century BC, who are credited with minting the first gold coins, transforming gold into a standardized medium of exchange and unit of account.

Gold and the Global Empires

As empires rose and fell, gold remained a constant symbol of wealth and power. From the Roman Empire, which systematically mined gold across its vast territories, to the Spanish conquests of the New World, which vastly increased Europe’s gold reserves, the pursuit of gold drove exploration, conquest, and trade.

The Gold Standard: Anchoring Global Currencies

The gold standard, formalized in the 19th century, linked currencies directly to gold, ensuring that governments could exchange paper money for its value in gold upon demand. This system facilitated international trade by providing a fixed currency exchange rate, stabilizing economies and reducing the risk of inflation. Although the gold standard was abandoned in the 20th century, its legacy of stability and trust continues to influence financial policies and the global economy.

The Modern Era: Gold in Today’s Financial Markets

Gold as a Hedge Against Inflation

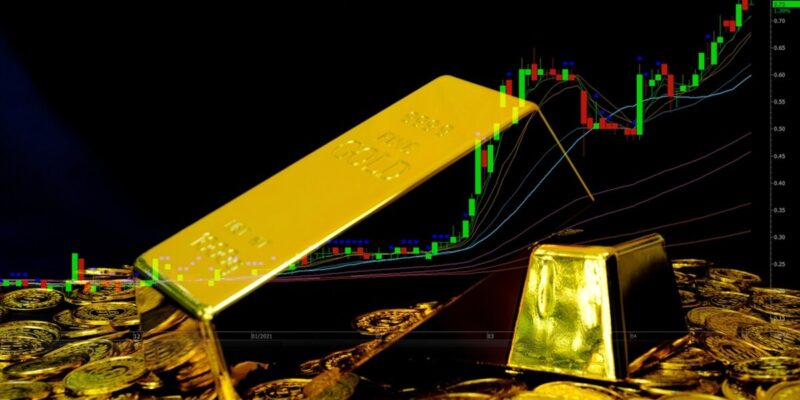

In contemporary financial markets, gold’s role has evolved, yet its essence as a store of value remains intact. Investors often turn to gold to hedge against inflation and currency devaluation. Unlike fiat currencies, gold’s value is not subject to government policies or the whims of the financial markets, making it an attractive safe-haven asset during times of economic uncertainty.

Gold and Diversification

Astute investors understand the importance of diversification in managing risk. Gold’s unique inverse relationship with the stock market and currencies makes it an invaluable component of a diversified investment portfolio. When stocks and bonds falter, gold often maintains or increases its value, providing a buffer against market volatility.

Gold Trading in the Digital Age

The advent of digital trading platforms has revolutionized how individuals and institutions trade gold. No longer confined to physical exchanges, traders can now buy and sell gold electronically, accessing global markets with the click of a button. This democratization of gold trading has broadened its appeal, attracting a new generation of investors drawn to its historical significance and intrinsic value.

Gold’s Cultural and Economic Impact

Beyond Wealth: Gold’s Cultural Significance

Gold’s impact extends beyond its economic utility, embodying cultural and symbolic meanings across societies. In many cultures, gold symbolizes purity, value, and achievement, evident in its use in religious artifacts, wedding dowries, and medals of honor. This cultural reverence for gold reinforces its value and desirability, contributing to its lasting appeal as an investment.

Gold and Technological Innovation

The technological advancements in gold mining and refining have mirrored humanity’s progress. From the ancient placer mines to modern extraction techniques, the pursuit of gold has spurred innovation in engineering, environmental management, and material science. Today, gold’s conductive properties make it an indispensable component in electronics, medical devices, and renewable energy technologies, highlighting its versatility and ongoing contribution to technological advancement.

The Future of Gold in Financial Markets

Looking forward, gold’s role in financial markets is poised to continue its millennia-long history of significance. As geopolitical tensions, economic fluctuations, and technological advancements unfold, gold’s inherent value as a stable investment, economic stabilizer, and technological component will likely adapt and endure. For investors, understanding gold’s historical journey provides a foundation for appreciating its potential future impact on portfolios and global markets.

Gold, with its deep historical roots and multifaceted role in today’s economy, remains a fascinating and pivotal element of the financial landscape. Its capacity to serve as a hedge against inflation, a diversification tool, and a bridge between the past and future of economic systems underscores its unmatched position in the financial world. As markets evolve and new challenges emerge, gold’s luster endures, offering a beacon of stability and value in an ever-changing economic horizon.